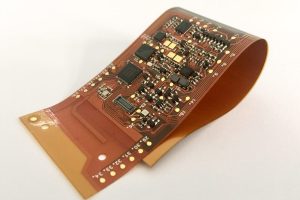

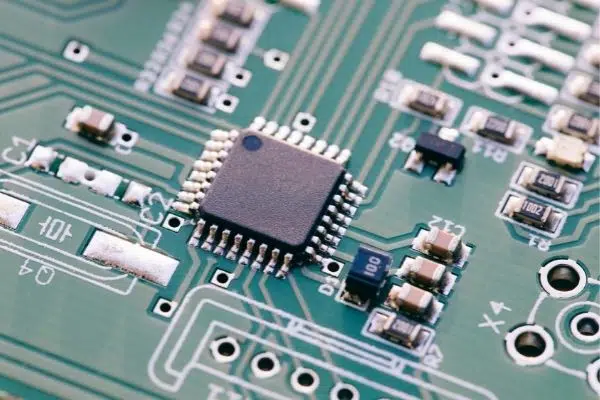

With the increasing requirements for “light, thin, short, and small” printed circuit boards, the demand of downstream industries has gradually shifted to higher-end products. FPC boards, HDI PCBs, and high-end Multilayer PCB board technology have become the main direction in the future.

The downstream applications of the PCB industry are extensive. We believe that the current industry growth mainly depends on the construction of communication infrastructure driven by 5G. The demands for high-frequency and high-speed boards, multilayer boards, and HDI boards are increasing. It is expected that the pulling effect brought by the communication infrastructure will rise by 2021. The consumer electronics field will start the 5G replacement wave in 2020, which will accelerate HDI expansion, flexible boards, and packaging substrates. The PCB industry will usher in a new wave of climax.

The application fields are vast, and the communication and server market has great potential.

In recent years, with the development of the electronics industry, product applications have covered various fields such as communications, consumer electronics, automotive electronics, computers, medical treatment, and aviation defense. Among them, communication, computer, and consumer electronics applications accounted for nearly 70% of the total. According to Primark statistics and forecast, from 2020 to 2023, the global compound annual growth rate of PCB output value of single/double panel and multilayer boards in the downstream field is about 3.7%, of which the highest compound growth rate is the wireless infrastructure that will reach 6.0 %, followed by server/storage (data center) and automotive electronics, the growth rate will get more than 5%.

Overall, the high-layer circuit board market represented by communications and servers/storage is the market with the highest demand and the fastest growth. According to Primark’s statistics, the PCB market for communication wired and wireless devices reached US$6.6 billion in 2018, and the server/memory PCB market reached US$5 billion. These three markets are all related to the development of the communications industry. Driven by the communications industry’s technological innovation and investment construction, the communication PCB market space is $11.6 billion.

Communication

PCB is mainly used in wireless communications networks, transmission networks, data communication networks and fixed-line broadband, and other sectors; 5G construction will boost the overall rise in the PCB industry chain. We believe that the peak period of 5G investment will come around 2021, and it is foreseeable that 5G construction will significantly drive the rapid growth of the PCB industry chain in the next 3-5 years.

Consumer Electronics

In recent years, AR (augmented reality), VR (virtual reality), tablet computers, and wearable devices have frequently become hot spots in the consumer electronics industry, superimposing the general trend of global consumption upgrades. Consumers have gradually moved from previous material consumption to service-oriented and quality consumption. PCB requirements for mobile terminals are mainly concentrated on HDI and flexible boards.

Server

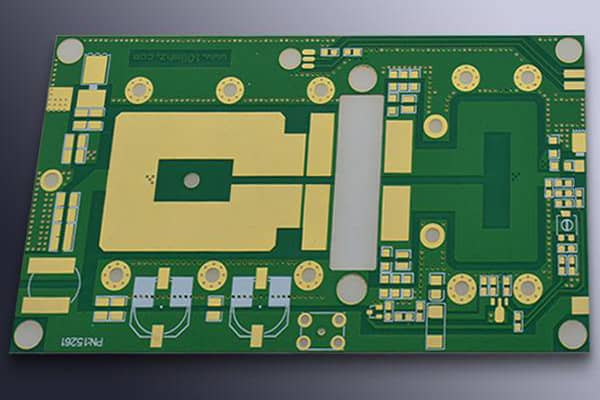

PCB demand in computers can be divided into segments such as personal computers and services/storage. The market for personal computers is saturated, and the growth rate is relatively slow, while the market size for services/storage is increasing. PCB requirements for service/storage are mainly 6-16 layers. The main features of PCB applications in high-end servers are reflected in the number of high layers, high aspect ratio, high density, and high transmission rate. The development of the high-end server market will also promote the PCB market, especially the development of the high-end PCB market.

The increase in the number of PCB layers places higher demands on the overall processing capabilities of circuit board manufacturers.

Industrial Control and Medical Equipment

Industrial control equipment can be regarded as a kind of reinforced enhanced computer used for industrial control to ensure the reliable operation of the industrial environment. Medical equipment refers to instruments, equipment, utensils, materials, or other items suitable for the human body, alone or in combination. Medical electronic products are mainly manifested as high-tech medical equipment in medical devices, whose essential characteristics are digitization and computerization, such as ultrasound, blood cell analyzer, and portable medical equipment.

According to statistics and forecasts, the demand for PCB boards in the global industrial control industry will reach USD 3.2 billion in 2021.

Automotive Electronics

Automotive electronics is the general term for car body automotive electronics and onboard automotive electronic control devices. It is an electronic control system composed of sensors, microprocessors, actuators, electronic components, etc. With the increasing demand for overall safety, comfort, and entertainment of automobiles, electronics, informatization, networking, and intelligence have become the development direction of automotive technology; at the same time, new energy vehicles, safe driving assistance, and unmanned driving technology are in the hot spot. The rapid development has enabled more high-end electronic communication technologies to be applied in automobiles. The proportion of automotive electronic systems in the cost of the entire vehicle is constantly increasing. The trend of automotive electronics is confirmed, and the trillion-level market is driving the steady growth of automotive PCB.

With the rapid development of automotive electronics, the working environment of automobiles is very complex, while the reliability of PCBs is exceptionally high. Automotive PCB requires that the operating temperature must meet -40 ℃ ~ 85 ℃. Generally, FR4 (flammable material grade, mainly glass cloth substrate) is used, and the thickness is 1.0 ~ 1.6mm.

PCB Development Trend Outlook Development

In terms of product types, due to the overall advancement of the PCB industry in the direction of high density, high precision, and high performance, products continue to shrink in size, they are lightweight and thin, and performance upgrades to meet the needs of different downstream application fields. Investment in precision HDI boards and IC packaging boards will continue to increase.

With the advancement of 5G and new energy vehicles, the application of multilayer boards in the fields of high speed, high frequency, and high heat will continue to expand. PCB products continue to lean toward high-tech fields in terms of quality and quantity, and enterprises will continue to increase their investment in technology research and development.

Related PCB Manufacturing Services

Related PCB Assembly Services

Related Posts

- IPC Standards: A Guide to Standards for PCB Manufacturing and Assembly

- Plated Through Hole, Blind Via, and Buried Via in PCB Fabrication

- 10 Types of PCB Surface Finishes: All You Need to Know

- what is solder paste used for

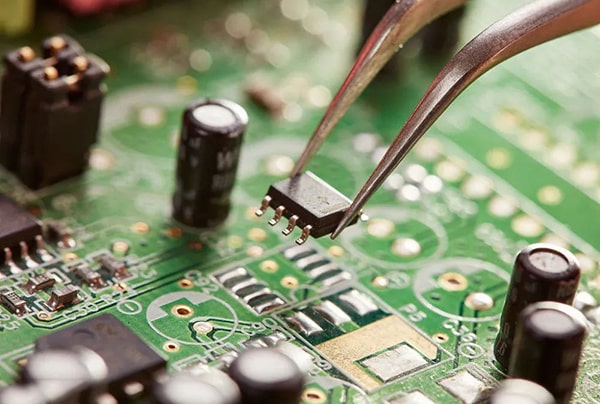

- What is the difference between SMT and SMD?

- how to test a circuit board for short?