As demand volatility persists for electronics and IoT devices amidst unstable global supply chains, original equipment manufacturers (OEMs) stand to gain by examining quick-turn PCB assembly manufacturing for prototyping and pilot production needs. Quick-turn PCB assembly services from capable China-based contract manufacturers provides manufacturing agility with rapid tooling, responsive assembly, expedited testing, and accelerated delivery.

Leveraging expert domestic manufacturers skilled in SMT, thru-hole assembly, and turnkey PCB assemblies further allows engineering teams to compress development timelines and race products to market through flexible low to medium volume production partnerships. This holds for ushering both iterative prototypes and scaled small batches for market evaluation beyond initial R&D trials.

This guide examines core competencies of reputed quick-turn PCB assembly experts in mainland China, ranging from Shenzhen to Shanghai to Wuxi manufacturing hubs. We unpack key assessments around lead time speed, quality control frameworks, process adaptability, and sample production cost-effectiveness. Determining if a provider matches short-term prototyping goals versus small-batch go-to-market readiness remains imperative during vetting.

Table of Contents

Quick-Turn PCB Assembly Technology and Process Flows

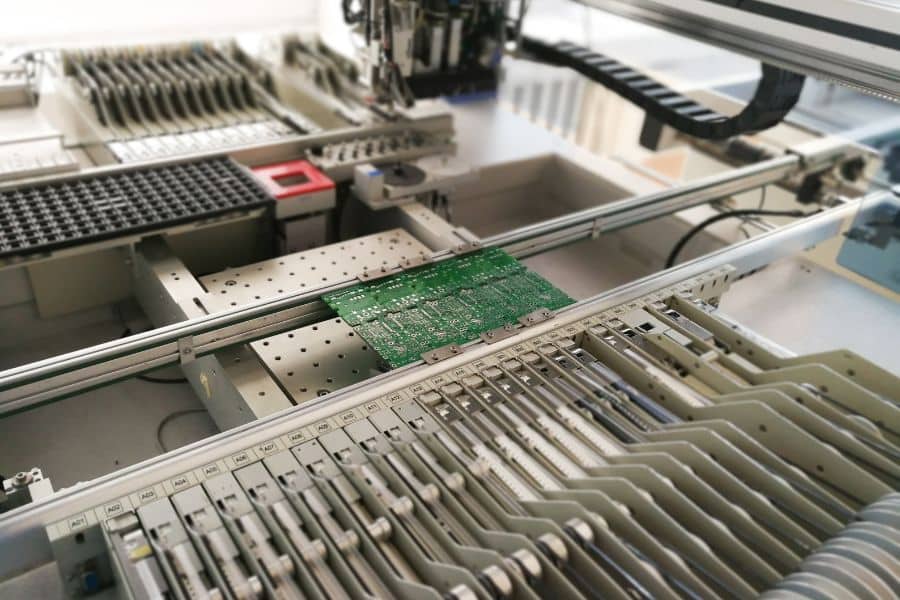

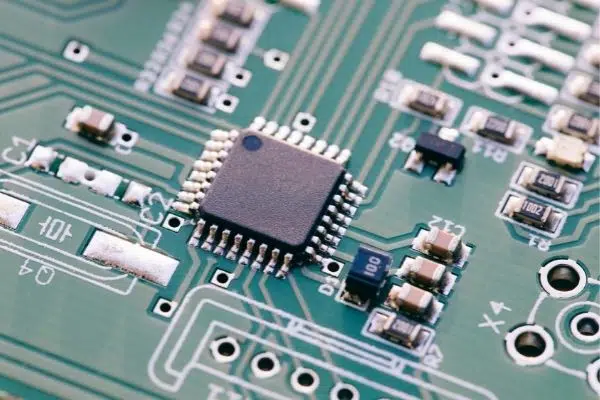

As PCB assembly continues trending from predominantly manual craftvention toward automated manufacturing, quick-turn services equip producers with responsive near-term output optionality between pure prototyping and interim pilot production during product development continuum.

Both mainstream assembly technology categories – surface mount technology and through hole technology – see widespread use within quick-turn manufacturing, sometimes in mixed mode combining SMT and THT for attachments needing leaded components. Key differentiators for competent quick-turn PCB assembly manufacturers include:

- Agile Component Sourcing

The ability to locate, procure, and manage custom component inventory for low volume production based on customer BOM needs separates leaders. Some utilize internal factories for making special parts adding vertical prowess. - Optimized Testing Capacity

Investment into testing functionality between assembly stages (like post SMT selective soldering) as well as expanded post-process quality assurance through flying probing, AOI, and functional test increases delivery confidence for complex builds. - Adaptable Assembly Programs

Utilizing automated programming on advanced mounters allows tweaking placement programs rapidly as prototypes iterate sans needing full re-tooling every design spin. This compressed evolution saves enormous time over full-fledged NPIs.

By evaluating quick-turn PCB assemblers across key technology cues like manufacturing automation degree, inspection rigor, supply adaptability and programming latitude, customers optimize matching amidst China’s many speed-capable options.

Capability Assessment of Quality Quick-Turn Assembly Manufacturers

Vetting PCB assembly manufacturing partners on capability grounds remains imperative before engagement. For quick-turn services, key assessment criteria span:

- Lead Time Speed

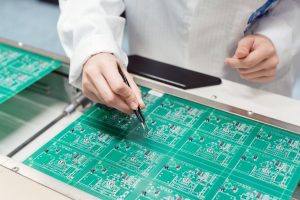

As the defining need for quick-turn assembly involves accelerated delivery, evaluating production lead time commitments proves paramount. Quality providers supply specific time estimates upfront for standard builds. Assessing acceleration options for more complex, high-mix orders also adds value. - Quality Control Rigor

As expedited manufacturing risks deprioritizing quality, reviewing process controls around workmanship, component traceability and change management, inspection checkpoints etc. provides assurance. Asking about quality certifications also portends excellence. - Flexible & Adaptive Processes

Since quick-turn assembly caters primarily low to medium volumes with prototype iterations, customized versus rigid processes allow fitting unique customer requirements. Evaluating tooling and programming agility provides insight. - Cost Effectiveness

The responsiveness and tooling demands of quick-turn builds often command pricing premiums. However assessing cost parameters around low-volume thresholds, expedited/standard lead variations, and component variables reinforces fit.

Regional Considerations for China-based Manufacturing

As multinational OEMs weigh manufacturing localization strategies balancing cost, speed, compliance and IP risks, China’s expansive electronics supply ecosystem offers compelling options to produce within mainland for domestic or Asia exports.

Quick-turn PCB assembly providers clustered around marquee electronics hubs each offer differentiated strengths for foreign customers:

- Shenzhen Region

As China’s foremost manufacturing capital renowned globally as the “Silicon Valley of Hardware”, Shenzhen and the Pearl River Delta house unparalleled choice density of capable assemblers benefitting from sustainable component availability and tooling ecosystems evolved over decades fostering efficiency. - Shanghai Region

With multinational R&D centers and China headquarters abound, leveraging swift local turn assembly services in Shanghai aids customer alignment allowing closer engineering collaboration for electronics firms centered here. - Wuxi and Suzhou Region

Extensive PCB assembly and semiconductor manufacturing gravitated multinational production around Wuxi/Suzhou. Leveraging manufacturers here may ease export logistics suiting foreign tech firms already localized within established supply parks.

From Prototyping to Small Batch Production

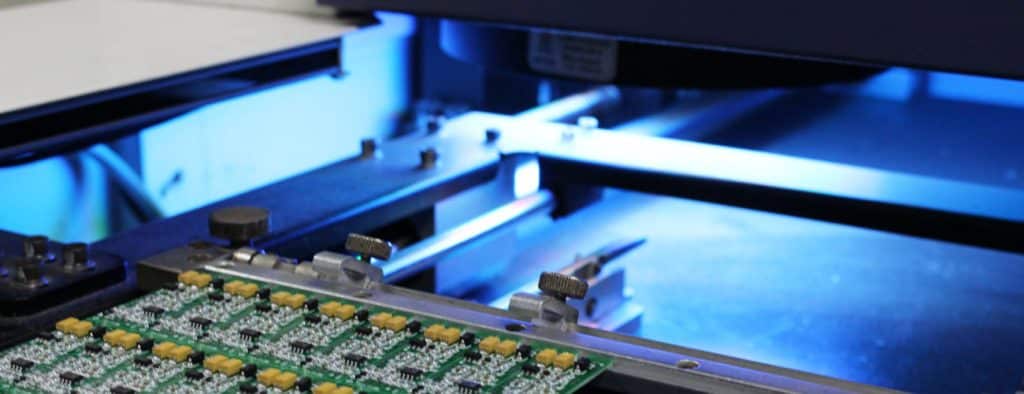

Quick-turn PCB assembly producers cater the full new product introduction continuum from early debugging trials to scaled small batches for commercial trials and early-stage go-to-market volumes.

- Prototyping Phase

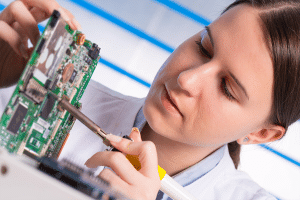

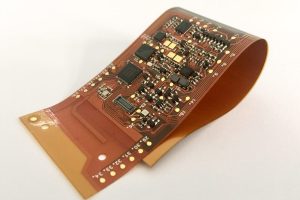

During iterative prototyping builds, technical competence assembling flexible boards, high density interconnects (HDI), and miniaturized components becomes paramount. Ensuring assembly partners hold expertise around delicate component workmanship proves prudent matching for this experimental phase. - Small Batch Ramp

As the design finalizes and shifts to tight-tolerance medium volume production, quality controls around assembly repeatability and minimization of workmanship defects provides confidence. The transition towards semi-automated volumes warrants inspection rigor neck-ups. - Low to Medium Production

When moving towards 500-5,000 units per month for market seeding and initial commercial ramps, production scale capabilities, component sourcing networks for BOM security, functional test capacities and quality change control processes require qualification preceding commitment.

By scoping manufacturer fit across distinct stages of the NPI progression cycle rather than solely assessing singular static capabilities, OEM customers improve commercialization success with trusted quick-turn partners in China.

Conclusion

As global electronics innovation and supply uncertainties continue accelerating, leveraging capable quick-turn PCB assembly manufacturers in China assists both foreign and domestic technology developers in condensing development timelines through responsive small batch partnerships.

Yet prudent selection remains essential preceding engagement by first qualifying assembly partners across critical dimensions. This allows focusing innovation resources on core product differentiation rather than peripheral supply aspects for mainland distribution.

With decades of expertise providing quick-turn services from prototyping to small batch production across SMT, THT and turnkey assemblies, JHYPCB welcomes inquiries from electronics innovators seeking accelerated China manufacturing. As a Shenzhen based company, we specialize in flexible, automated solutions catering volatile consumer electronics and IoT supply needs.

Please reach out to explore how our optimized China-based capabilities can expedite and derisk your upcoming product deployment through tailored quick-turn PCB assembly collaboration.