On November 2, DuPont announced that it had reached a final agreement to acquire Rogers Corporation for US$5.2 billion.

DuPont announced on November 2 that it would acquire electronic materials manufacturer Rogers for US$5.2 billion and plans to sell most of its engineering plastics business.

Background of the transaction

DuPont is a chemical company dedicated to providing technology-based materials and solutions. Its business is mainly distributed in three areas. In the electronics and industrial fields, it serves the semiconductor, circuit board, display, and healthcare industries; in the field of fluidity and materials, its high-performance engineering polymers, resins, adhesives, and unique pulps Materials and films can provide material system solutions for applications and environments in the medical, photovoltaic and telecommunications industries; in the field of water and protection, it has developed high-performance fibers and foams, water purification technologies and protective clothing, including Kevlar, Nomex, Corian, Great Stuff and other brands.

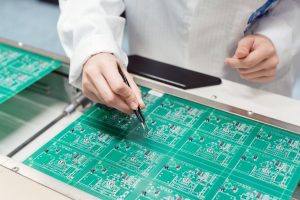

Rogers is an electronic material manufacturer with a leading position in high-frequency circuit materials, ceramic substrates for power semiconductor devices, and high-performance foams. It is expected that sales in 2021 will reach approximately US$950 million and employ 3,500 employees in 14 manufacturing sites in North America, Europe, and Asia.

Details of the transaction

DuPont agreed to acquire Rogers Corporation, a manufacturer of engineered materials technology, for US$5.2 billion. The transaction is expected to be completed in the second quarter of 2022. The acquisition is subject to customary conditions for completing the transaction, including obtaining Rogers’s shareholder approval and receiving applicable regulations approval.

JPMorgan Chase Securities Co., Ltd. acted as Rogers’ exclusive financial advisor for this transaction, and Covington & Burling LLP and Hinckley, Allen & Snyder LLP acted as external legal advisors.

The meaning of trading

In the early stage, after the merger of Dow and DuPont, the chemical group was divided into three companies, and DuPont later became an enterprise focusing on industrial solutions. In the field of electronic materials, following the acquisition of Laird high-performance materials in July, Rogers, the leader in advanced material solutions, will be acquired again, which will consolidate its position in fast-growing markets such as electric vehicles and 5g.

At the same time, Rogers’ cooperation with DuPont will contribute to their long-term growth in electric vehicles, hybrid vehicles, advanced driving assistance systems, and other key markets.

Bruce D. hoechner, President and CEO of Rogers, said: “As a leading supplier of advanced materials solutions, DuPont is very suitable for Rogers. DuPont is a recognized leader in the field of advanced unique materials. Rogers will benefit from DuPont’s global influence and substantial technical and commercial depth. Like DuPont, Rogers’s success is based on a dedicated team committed to excellence and technology leadership to solve the most complex problems of customers Complex application challenges. This combination will create an exciting new chapter for Rogers’ customers, employees, and partners. “

Introduction to Rogers company

Rogers completed the merger and acquisition of Arlon bairnco, a world-famous manufacturer of high-frequency communication materials, in January 2015 and owned 100% of its equity. Yalong is in a leading position in the field of microwave / RF substrate in high-frequency communication materials. Its ad-c series products have become the leader of PCB substrate for base station antenna, and its top substrate products are mainly oriented to the high-end antenna market. The completion of the Yalong acquisition has greatly enhanced Rogers’ market competitiveness in the field of high-frequency communication materials.

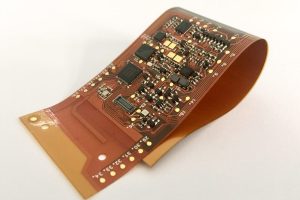

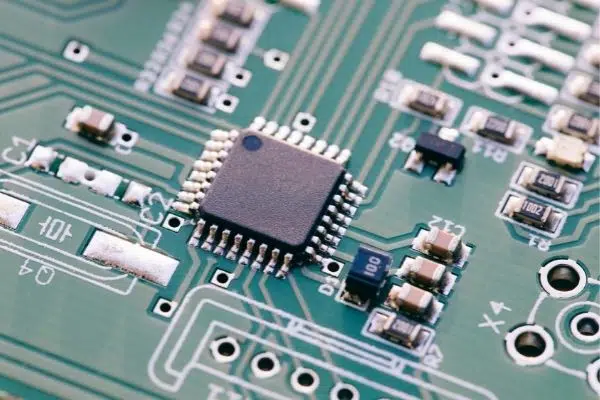

Rogers’ AMB active metal brazing substrates and DBC direct copper-clad substrates are world leaders in terms of ceramic substrates. They can provide cermet substrates based on alumina Al2O3, aluminum nitride AlN, silicon nitride Si3N4, and so on.

Rogers’ ceramic substrate has the characteristics of high thermal conductivity, long service life, high heat capacity, and high heat diffusion. It is an indispensable component of power electronic products. The thermal expansion coefficient of the ceramic substrate is low, so its performance is significantly better than that of a substrate made of metal or plastic.

In recent years, the performance of Rogers company has also improved year by year. According to the recent financial report, the net profit attributable to the ordinary shareholders of the parent company in the second quarter of the fiscal year 2021 was US $28.655 million, a year-on-year increase of 97.35%; The operating revenue was US $235 million, a year-on-year increase of 22.89%. For the growth of performance, Rogers said that the company continued to make significant investments during the whole epidemic period and achieved good performance.