Since Q3 of 2020, both ends of the PCB industry chain have shown key changes.

Demand Side:

The epidemic has driven and boosted shipments of consumer terminals, including PCs and tablets, and new smartphone products in Q4, especially the Chinese market’s 5G. Strong demand for mobile phones has led to an increase in shipments.

In 2020, global notebook shipments reached 200 million units, a year-on-year increase of 22.5%. The growth rate continued to increase from Q2 to Q4, reaching 54% in Q4. It is expected that there will be a chance to reach 217 million units in 2021, which is an increase of 8.6% year-on-year (according to Strategy Analytics).

The global smartphone shipments were 1.292 billion units in 2020. It is a year-on-year decline of 5.9%. In the context of a 1% year-on-year decline in Q3, the growth rate of Q4 began to turn positive with a positive growth of 4% year-on-year and shipments of 386 million units. The whole year shipments for 5G smartphones were 200 million units, with a penetration rate of 16%. The Chinese market shipped 163 million units, accounting for 82%, with a penetration rate of 55% (IDC). It is expected that smartphone shipments will continue to rise in 2021. According to the Ministry of Industry and Information Technology, the country’s smartphone shipments were 39.57 million units in January 2021, a year-on-year increase of 94%, of which 27.28 million were 5G mobile phones, and the penetration rate increased to 68%.

In 2020, the country’s auto sales will continue to rank first in the world. The China Association of Automobile Manufacturers believes that the country’s autos will achieve recovery and positive growth in 2021. Auto sales are expected to exceed 26 million units, a year-on-year increase of 4%. New energy vehicles are expected to reach 1.8 million, an increase of 40% year on year. In the longer term, the penetration rate of new energy vehicles is expected to increase gradually.

Supply Side:

Since April 2020, the LME copper price has continued to rise. According to data, the increment is 85%. Since February this year, the copper price has continued to rise, and the increment is 16%. The rise in copper prices drives up the price of copper foil, which is an important raw material for copper-clad laminates, and it accounts for more than 30% of the cost. In addition, the cost of glass fiber and resin is in the range of 25% to 30%. From mid-December last year to mid-February this year, the glass fiber (Shenwan) index increased by 45% and has fallen by about 10% since mid-February.

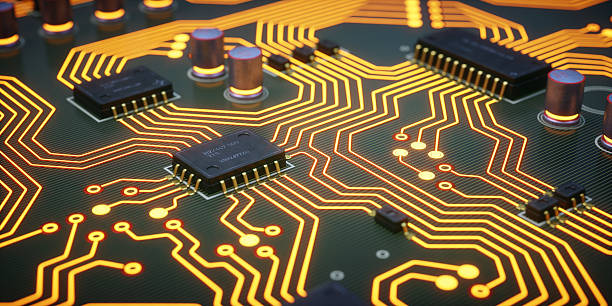

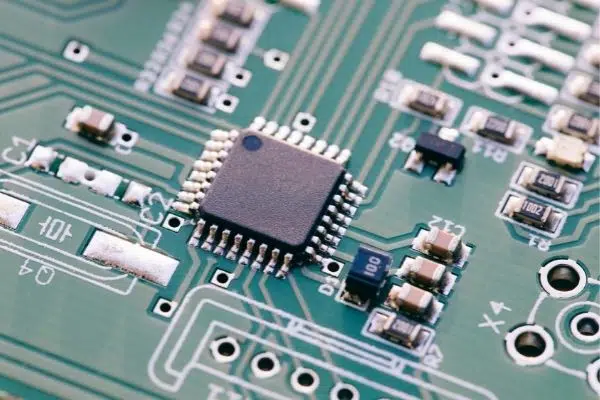

PCB and CCL

Judging from the history of the increase in the gross profit rate of copper clad laminate manufacturers driven by the increase in raw material prices from 2016 to 2017, the increase in the price of upstream raw materials and the strong downstream demand are conducive to the increase in the gross profit margin of copper clad laminate manufacturers. However, price transmission is affected by different product types. The lower the sheet material, the greater the impact of raw material price fluctuations. In this regard, benefiting from the profit flexibility brought about by the increase in raw material prices and the increase in capacity utilization, Shengyi Technology, and Huazheng New Materials are recommended, and Nanya New Materials is as well.

The long-term growth space of PCB lies in the demand boom and industry supply pattern changes, rather than upstream copper-clad laminate price fluctuations. Consumption will benefit from the penetration of 5G smartphones this year and the next year, and demand is expected to be booming. The absolute value of communications this year will be stable year-on-year (changes in equipment vendors’ plans are a risk), but the growth rate may not be as fast as the same period in 2019. The new energy trend is upward, but the industry chain is relatively closed, and the increase in penetration rate is not as good as communications; servers are worthy of attention, and the certification cycle is relatively short, which has long benefited from cloud computing and the increase in the share of local manufacturers. Benefiting from downstream communications and server demand, Shennan Circuit and Shanghai Electric Power Company Ltd. are recommended.

Risk Warning: 5G commercial progress is not as expected, demand for cars and servers is not as high as expected, and CCL prices are not as high as expected.

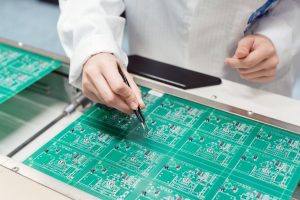

JHYPCB, a professional PCB fabrication and assembly manufacturer in China, provides PCB prototype manufacturing service, Fast Prototype PCB Assembly Service, LED PCB assembly, SMT PCB Assembly, Through Hole PCB Assembly, and Components Purchasing Services. We are the right partner for your printed circuit board business.